Auto Insurance in and around Tulsa

Take this great auto insurance for a spin, Tulsa

All roads lead to State Farm

Would you like to create a personalized auto quote?

Insure For Smooth Driving

The variety of deductibles and coverage options can be a lot to think about. Like a good neighbor, agent Oanh Stanger is here to help you investigate State Farm's great auto insurance options that set them apart.

Take this great auto insurance for a spin, Tulsa

All roads lead to State Farm

Great Coverage For A Variety Of Vehicles

State Farm offers reliable flexible coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are some of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Oanh Stanger can confirm which ones you qualify for to make a policy for your unique needs.

Plus, your coverage can be aligned with your lifestyle, to include things like car rental insurance and Emergency Roadside Service (ERS) coverage. And you can cover a variety of vehicles—whether it's a motorcycle, motorhome, boat or recreational vehicle.

Have More Questions About Auto Insurance?

Call Oanh at (918) 749-2271 or visit our FAQ page.

Simple Insights®

How to prevent car theft

How to prevent car theft

Tips to help prevent car theft and auto break-ins, including car alarm, VIN etching, smart keys and more.

Buying tips: Insurance for sports cars

Buying tips: Insurance for sports cars

Thinking of buying a sports car? Learn why insurance might cost more, what factors affect your premium and why getting car insurance quotes first is important.

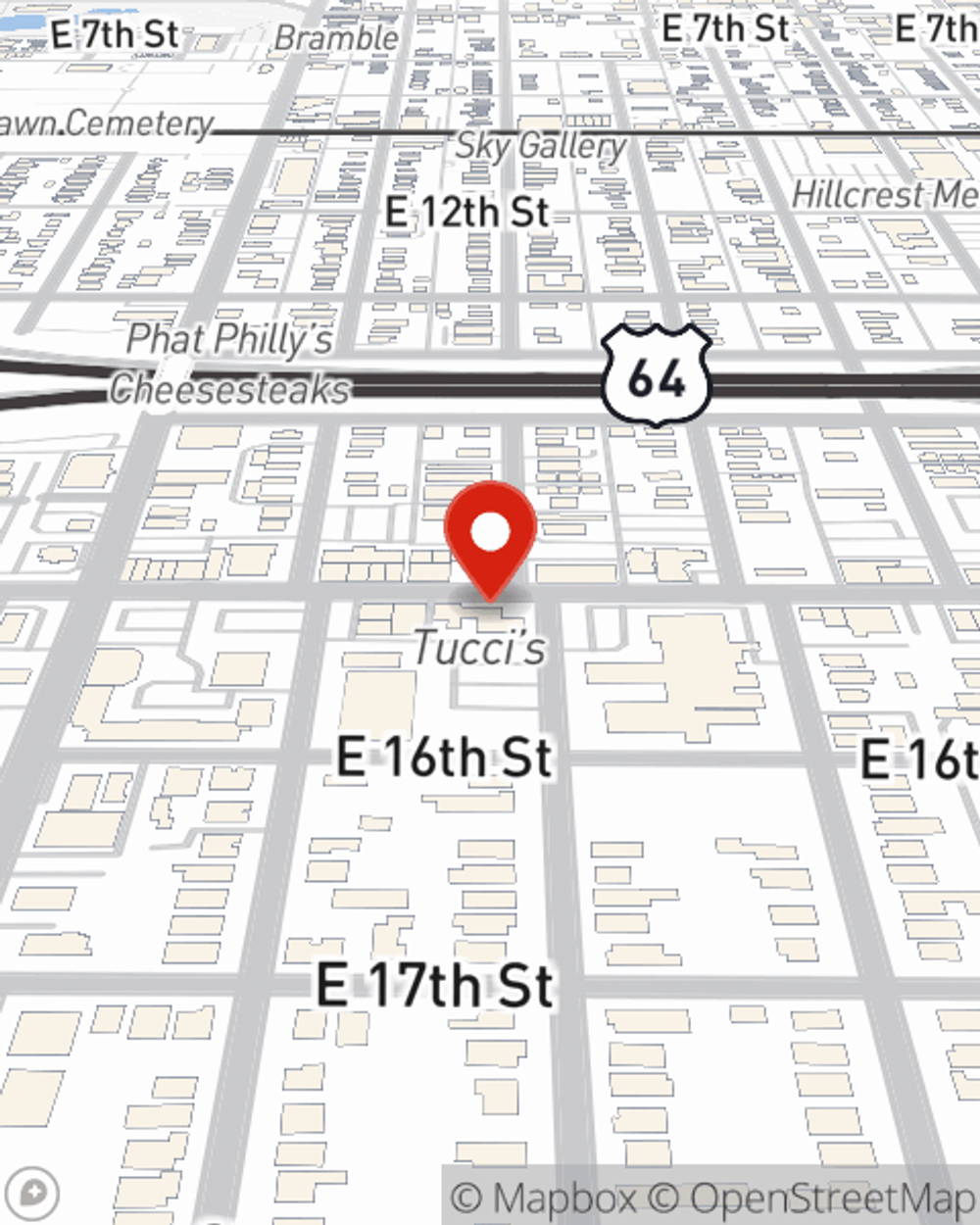

Oanh Stanger

State Farm® Insurance AgentSimple Insights®

How to prevent car theft

How to prevent car theft

Tips to help prevent car theft and auto break-ins, including car alarm, VIN etching, smart keys and more.

Buying tips: Insurance for sports cars

Buying tips: Insurance for sports cars

Thinking of buying a sports car? Learn why insurance might cost more, what factors affect your premium and why getting car insurance quotes first is important.